A few days ago, CITIC Group released the "Carbon Peak Carbon Neutral Action White Paper" on its official website, which further clarified the specific action path for the group to achieve its carbon neutrality goal. This is another important measure taken by CITIC Group following the "two increases and one decrease" low-carbon development strategy proposed last year.

CITIC Group has explored and compiled a “dual-carbon” profit and loss statement through a comprehensive survey of carbon emissions during the “Thirteenth Five-Year Plan” period to ensure that the implementation of the “dual-carbon” strategy is clear, transparent and traceable. On this basis, for the first time The carbon neutrality roadmap covering the five business segments of the Group was announced.

Comprehensive investigation and preparation of "double carbon" profit and loss statement

In response to the national "double carbon" goal, CITIC Group held a seminar on "Carbon Peak and Carbon Neutral Road" last year, and officially released a low-carbon development strategy of "two increases and one reduction". "Two increases" is reflected in green finance to provide financing solutions for industrial low-carbon transformation, industrial development to amplify the low-carbon effect of industrial chain and ecological circle as its own responsibility; "One reduction" is reflected in the group's stock of high carbon business, high environmental impact investment to actively promote low-carbon transformation, new business layout should be low-carbon emission reduction, low environmental impact as the principle.

Path for further scientific planning of carbon neutral targets, and in September 2021, CITIC Group refer to the National Development and Reform Commission and the ecological environment of enterprises such as greenhouse gas emissions standards, of its five major business sector carbon emissions verification to 36 subsidiaries, fully understand its "carbon base", "double carbon" profit and loss account is compiled, And it will be used as a dynamic management tool to achieve the goal of carbon neutrality, so as to ensure that the "double carbon" strategy can be backtracked, monitored and evaluated.

According to the comprehensive survey, during the "13th Five-Year Plan" period, CITIC Group continued to optimize resource allocation and increase green finance investment, while actively promoting industrial subsidiaries to control carbon emissions by strengthening technological transformation and innovating production processes. In 2020, CITIC Group's annual carbon emissions were 43.84 million tons, an increase of 16% compared with 2016, which was 47% lower than the output growth rate.

CITIC Group has also made a corresponding forecast for the carbon gains and losses during the 14th Five-Year Plan period, which is expected to achieve an average annual emission reduction of more than 500,000 tons. Considering the existing industrial scale, future development plans, energy conservation and emission reduction plans, and other factors, CITIC Group's carbon emission intensity per unit of output value is expected to decrease by 18% by 2025 compared with 2020.

Next, CITIC Group will continue to carry out the special accounting of the "double carbon" income statement, and will regularly disclose the implementation of the "double carbon". Relying on the corporate governance mechanism, it will steadily improve the ESG information disclosure quality of Citic Shares, listed companies at all levels and bond issuers.

Scientific planning charts a road map to carbon neutrality

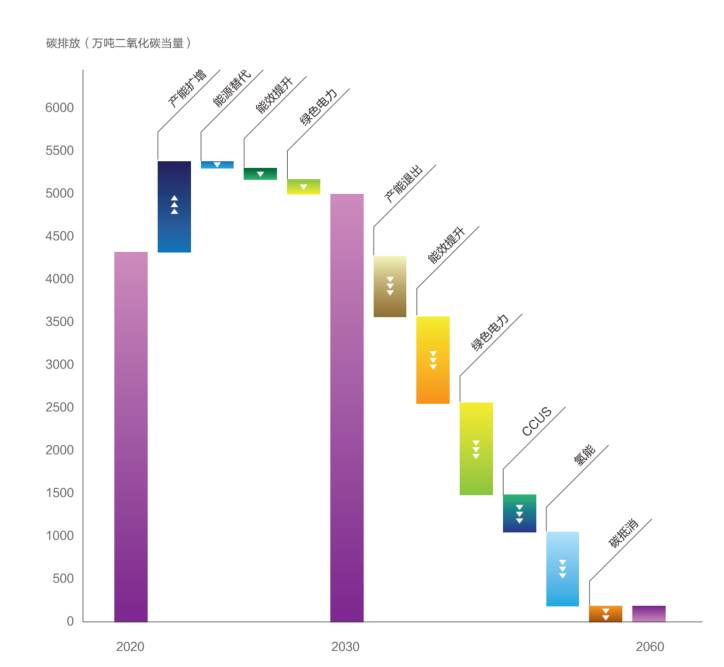

How to achieve carbon neutrality step by step? CITIC Group has given a clear roadmap in its white paper on "double carbon" action:

An

overview of CITIC Group's carbon neutral path

The

first is to vigorously carry out energy conservation and carbon reduction work

in four key areas, such as power industry, steel production, building operation

and data center, to find potential opportunities for energy efficiency

improvement, structure optimization and technology emission reduction in their

respective fields, so as to effectively reduce carbon emissions. At the same

time, the remaining carbon emissions will be offset to achieve overall net zero

carbon emissions.

Secondly, carbon neutrality cannot be achieved without building carbon capacity. CITIC Group will strengthen carbon asset management, establish a comprehensive carbon information management system, integrate carbon emission data, carbon credit assets, carbon trading, emission reduction projects and other relevant information to support carbon management analysis and decision-making; Integrate "double carbon" thinking into daily operation and management, and increase the training, introduction and reserve of professionals in the field of "double carbon".

In addition, while doing well in its own emissions reduction, CITIC Group also actively helps the whole society to reduce carbon emission. CITIC Group helped external companies and individuals achieve indirect carbon dioxide emission reductions of about 20 million tons in 2020.

In the industrial sector, CITIC Decca's automotive aluminum castings are lightweight products, losing a third of their weight compared with traditional steel components. CITIC Metals promotes the application of niobium products in China's iron and steel industry. The application of niobium-containing steel has significantly improved the strength and toughness of steel and achieved a weight reduction of 22.5%-50%.

In the financial sector, by the end of December 2021, China CITIC Bank's green credit balance was 200 billion yuan, up 140% from the beginning of the year; CITIC Securities and CITIC Jiantou Securities ranked first in the industry in the amount of green bonds issued in 2021. In the next step, CITIC Group will continue to increase the scale and proportion of green finance business, and accelerate the innovation of green finance business model; Take CITIC Financial Holding Company as the carrier to strengthen risk management and deepen the synergy of green finance business; Actively participate in the construction of green finance evaluation system of financial regulatory authorities, and promote the improvement of domestic green finance standards and the integration with international standards.

We will firmly promote green growth to support the country's "double carbon" goals

Under the carbon neutral path, a green and low-carbon enterprise should have the following characteristics: low-carbon or even net zero carbon operation in the production process; The business model takes into account environmental and economic benefits, and helps the whole society to reduce carbon emissions through the industrial chain. CITIC Group will continue to make efforts in this direction, and will firmly promote green and low-carbon business as a new growth point of the company.

Schematic diagram of CITIC Group's carbon neutral route

CITIC Group is committed to achieving significant results in its comprehensive green and low-carbon transformation by 2030, with its overall carbon emissions reaching a peak and achieving a steady decline. By 2060, it will be fully integrated into the industrial system of green, low-carbon and circular development and the clean, low-carbon, safe and efficient energy system, and its energy utilization efficiency will reach the advanced level of a world-class enterprise, making positive contributions to the national goal of carbon neutrality.

日前,中信集团在官网发布《碳达峰碳中和行动白皮书》,进一步明确集团实现碳中和目标的具体行动路径。这是中信集团继去年提出“两增一减”低碳发展战略后的又一重要举措。

中信集团通过对“十三五”期间的碳排放全面摸底盘查,探索编制“双碳”损益表,确保“双碳”战略实施的清晰透明、有迹可循,并在此基础上首次公布了覆盖集团五大业务板块的碳中和路线图。

全面摸底 编制“双碳”损益表

中信集团积极响应国家“双碳”目标,去年举办了“碳达峰、碳中和之路”研讨会,对外正式发布“两增一减”的低碳发展战略。“两增”体现为绿色金融为产业低碳化转型提供融资解决方案,实业发展以放大产业链和生态圈的低碳效应为己任;“一减”则体现为集团存量中高碳业务、高环境影响投资要积极推进低碳转型,新业务布局要以低碳减排、低环境影响为原则。

为进一步科学规划碳中和目标实施路径,2021年9月,中信集团参考国家发改委和生态环境部等制定的企业温室气体排放标准,对旗下五大业务板块36家子公司进行了碳排放核查,全面摸清自身“碳家底”,编制了“双碳”损益表,并将其作为实现碳中和目标的动态管理工具,以确保“双碳”战略的可回溯、可监测、可评价。

根据全面摸底,“十三五”期间,中信集团在持续优化资源配置、加大绿色金融投入的同时,积极推动实业子公司通过加强技术改造、创新生产工艺等方式控制碳排放。2020年全年中信集团碳排放量为4,384万吨,相比2016年增长16%,低于产值增速47%。

中信集团对“十四五”期间的碳损益也作了相应预测,预计“十四五”期间年均减排将达到50万吨以上。综合考虑现有产业规模、未来发展规划和节能减排计划等因素,到2025年,中信集团单位产值碳排放强度预计将比2020年下降18%。

接下来,中信集团将继续开展“双碳”损益表的专项核算,并将定期披露“双碳”执行情况,依托公司治理机制,稳步提升中信股份和各级上市公司、发债主体的ESG信息披露质量。

科学规划 描绘碳中和路线图

如何一步步实现碳中和?中信集团在“双碳”行动白皮书中给出了清晰的路线图:

中信集团碳中和路径概览

首先是针对电力工业、钢铁生产、建筑运营和数据中心等四个重点领域大力开展节能降碳工作,寻找各自领域能效提升、结构优化以及技术减排的潜在机遇点,有效降低碳排放;同时对剩余碳排放引入抵消计划,最终实现整体净零碳排放。

其次,实现碳中和,离不开碳能力的建设。中信集团加强碳资产管理,将建立综合化的碳信息管理体系、整合碳排放数据、碳信用资产、碳交易、减排项目等相关信息以支持碳管理分析决策;将“双碳”思维融入日常经营管理工作,加大“双碳”领域专业人才培养、引进及储备。

此外,中信集团在做好自身减排的同时,还积极助力全社会降碳减排。中信集团在2020年助力外部企业和个人实现间接二氧化碳减排约2,000万吨。

在实业领域,中信戴卡生产的汽车铝铸件属于轻量化产品,相较于传统钢铁材质零部件减重三分之一。中信金属推动铌产品在中国钢铁工业的应用,含铌钢的应用显著提升了钢的强度和韧度,实现减重22.5%-50%。

在金融领域,截至2021年12月末,中信银行绿色信贷余额2,000亿元,较年初增长140%;中信证券和中信建投证券2021年绿色债券发行金额位居行业前列。下一步,中信集团将持续提升绿色金融业务规模与占比,加速绿色金融商业模式创新;以中信金融控股公司为载体,强化风险管理,深化绿色金融业务协同;积极参与金融监管部门的绿色金融评价体系建设,并推动绿色金融国内标准的完善以及与国际标准的融合。

坚定推动绿色增长 助力国家“双碳”目标

在碳中和路径下,一家绿色低碳企业应具备以下特征:生产过程中实现低碳甚至净零碳运行;经营模式兼顾环境与经济效益,通过产业链助力全社会碳减排。中信集团将朝此方向持续努力,并将坚定推动绿色低碳业务成为公司的新增长点。

中信集团碳中和路线示意图

打造绿色低碳街区,奏响幸福美好生活最强音

10-18 · 来源:湖北省武汉市江汉区北湖街道环保社区 · 作者:湖北省武汉市江汉区北湖街道环保社区

“碳惠冰城”:东北首个市级平台的“双碳”实践与冰城示范

10-15 · 来源:哈尔滨产权交易所有限责任公司 · 作者:哈尔滨产权交易所有限责任公司

亚洲气候治理新篇章:中国公益代表团参访曼谷气候周,探索跨区域合作新路径

10-10 · 来源:公益时报 · 作者:公益时报